7 Common Rental Scams to Avoid in 2025: Spot Real Estate Fraud Fast

7 Common Rental Scams to Avoid in 2025: Protect Yourself from Real Estate Fraud

In today's competitive housing market, finding the perfect rental can feel like a race against time—especially with rents climbing and inventory low. But amid the urgency, rental scams are surging, preying on desperate renters and costing victims millions. According to recent reports, over 5.2 million Americans fell victim to rental fraud in 2025 alone, with a staggering 43% of renters encountering fake listings during their search. The average loss per scam? A painful $2,071, up 21% from prior years. Even worse, 43% of victims never recover their funds.

As experts at Placerville Realty and Big Oak Management, we've seen these schemes firsthand—scammers copying our legitimate listings within minutes and vanishing with deposits. While it's a tough topic, awareness is your best defense. In this guide, we'll break down the 7 most common rental scams in 2025, how they operate, and proven strategies to avoid rental fraud. Whether you're hunting for a family home or a short-term stay, these tips will help you rent smarter and safer.

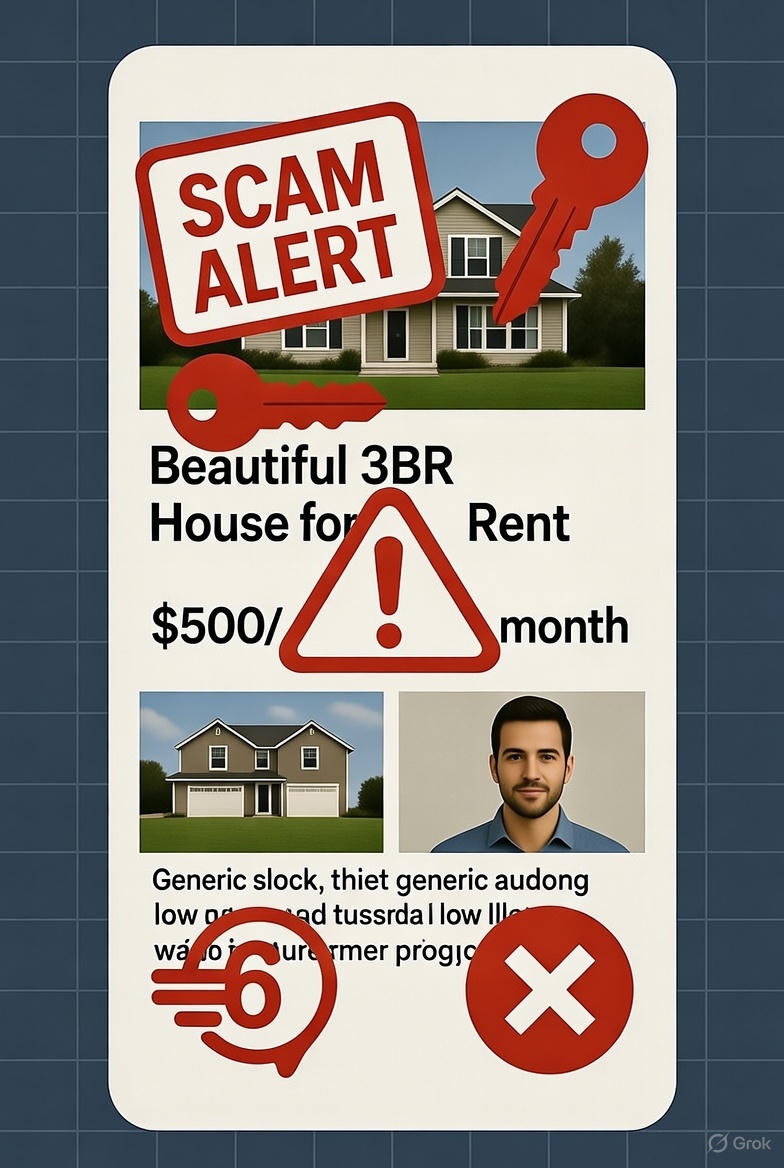

1. Fake Rental Listings: The Phantom Property Trap

Fake listings remain the top real estate rental scam in 2025, accounting for nearly one-third of encounters. Scammers steal photos and details from genuine ads on sites like Zillow or Redfin, then repost them on unregulated platforms at rock-bottom prices to lure in bargain hunters.

How It Works

- They swap out contact info with their own, often slashing rent by 20-50% to create FOMO (fear of missing out).

- We've spotted duplicates of our managed properties—some occupied for years—popping up on Facebook Marketplace and Craigslist within 20 minutes of our posts going live.

- Pro tip: These scams exploded 64% this year, fueled by AI-generated images that look hyper-realistic.

How to Avoid Fake Rental Listings

- Stick to verified platforms: Search only on dedicated real estate sites like Zillow.com, Redfin.com, Realtor.com, Homes.com, Apartments.com, or Avail.co. These enforce one listing per property, blocking easy copies. (Note: Placerville Realty and Big Oak Management never list on Craigslist or Facebook Marketplace.)

- Reverse image search: Upload listing photos to Google Images or TinEye to check for duplicates. Also, Google the address—mismatched prices or contacts are red flags.

- Cross-verify ownership: Pull public records via county assessor sites or the platforms mentioned above. Don't rely on in-person visits alone; scammers have been caught breaking into vacant "for sale" homes to stage fake tours.

By sourcing from legit sites, you'll dodge 90% of these traps and ensure you're dealing with real rental properties.

2. Upfront Payment Demands Before Viewings: The "High Demand" Hustle

With rental demand at record highs, scammers exploit the pressure by demanding cash before you even step foot inside. This landlord scam surged 40% nationwide in 2025, hitting desperate tenants hardest.

How It Works

- The fraudster claims the property is in "high demand" and insists on a security deposit or application fee via wire transfer, Venmo, or Zelle—before any viewing.

- Victims report being told the "manager is out of town" but were instructed to peek through windows, snap photos, and wire money for a "discounted" lease. And as quick as that, their money is gone.

- It's especially rampant for deals that sound "too good," like below-market rents in hot areas.

- We get calls all the time warning us of these kinds of scams... Placerville Realty and Big Oak Property Management will never demand money up front.

How to Spot and Avoid Upfront Money Scams

- View first, pay never: Always tour the property in person with the landlord or verified manager. No exceptions.

- Insist on formal meetings: If they're "unavailable," walk away. Legit pros like those at Big Oak Management schedule walkthroughs promptly.

- Question unbeatable deals: If the rent undercuts comps by more than 10-15%, run a quick market check on Zillow or Apartments.com.

Remember: Real landlords can't legally demand full payment sight-unseen. This scam alone drained $145 million in real estate fraud losses last year.

3. Rushed or Missing Lease Agreements: The Pressure Play

Scammers hate paper trails. They skip formal leases or rush you into signing blurry PDFs to lock in your deposit fast.

How It Works

- You'll get a verbal "deal" or a hastily emailed agreement with typos, missing clauses, or no proof of the landlord's authority.

- Pressure tactics like "Sign now or lose it!" create panic, especially for families in a bind.

How to Avoid Lease Signing Scams

- Demand a written lease: Review it line-by-line, ideally with a lawyer or free template from Nolo.com. Ensure it includes rent terms, utilities, and eviction rules.

- Verify authority: Ask for ID, property deed proof, or a management company reference. If the so-called manager rejects your request - move on.

A solid lease protects both sides—scammers know that and bolt when you push back.

4. Impersonating Real Estate Agents or Property Managers: The Double-Booking Deception

Fraudsters pose as pros from firms like ours, collecting fees from multiple "tenants" for one property. This fake agent scam is up due to easy online impersonation tools.

How It Works

- They schedule back-to-back tours, pocketing deposits from each eager renter.

- Victims arrive move-in day to find the unit "already leased"—or worse, occupied.

How to Avoid Fake Agent Scams

- Source from trusted channels: Again, bypass Craigslist/Facebook; use Realtor.com, Zillow.com, or direct agency sites like PlacervilleRealtyInc.com.

- Check credentials: Verify licenses via state real estate boards (e.g., California's DRE.ca.gov). Call the "agency" independently.

Pro managers like Big Oak never demand fees without full vetting.

5. "Too Good to Be True" Deals: The Bait-and-Switch Classic

Unrealistically low rents or security deposits scream SCAM. In 2025's tight market, these lure in 1 in 3 victims.

How It Works

- Listings promise luxury at budget prices, vanishing after your deposit hits their account.

- Often tied to fake listings, with AI polishing the illusion.

How to Avoid Unrealistic Rental Deals

- Run comps: Use Rent.com or local MLS data to benchmark similar units. Aim for market rate ±10%.

- Follow the axiom: If it's too good, it's probably fraud. Cross-check everything.

- Budget realistically: Factor in deposits (1-2 months' rent) and fees—legit totals rarely shock.

6. Fake Airbnb or Short-Term Rental Scams: Vacation Voucher Vanish

Short-term hustles mimic long-term ones but target travelers. Platforms like Facebook see spikes here.

How It Works

- Bogus listings demand full upfront payment for "vacation steals," then ghost you.

- Wire transfers or gift cards are their MO—no refunds.

How to Avoid Short-Term Rental Fraud

- Book via pros: Stick to Airbnb, Vrbo, or Booking.com with buyer protection.

- Ditch risky payments: No wires, Venmo, or Zelle for rentals—use platform escrow.

- Verify hosts: Read reviews, check profiles, and video call before paying.

7. Key Exchange Scams: The Mailed Mirage

Out-of-town "landlords" promise keys after deposit— but they never arrive.

How It Works

- You wire money; they "ship" fake tracking numbers or nothing at all.

- Common for remote or international fraudsters.

How to Avoid Key Exchange Tricks

- In-person only: See the unit and hand over keys personally.

- No remote payments: Verify identity via video or notary first.

- Trust local pros: Agencies like Placerville Realty handle exchanges securely.

Quick Comparison: Rental Scam Red Flags vs. Legit Signs

| Red Flag (Scam) | Legit Sign (Safe Rental) |

|---|---|

| Demands payment before viewing | Free tours scheduled easily |

| Craigslist/Facebook listing | On Zillow/Realtor.com only |

| Too-low rent (20%+ below market) | Matches local comps |

| No written lease | Detailed, reviewed agreement |

| Wire/Zelle requests | Secure platform or check payments |

Final Tips to Stay Safe from Rental Scams in 2025

- Verify everything: Google the landlord, check BBB.org ratings, and pull ownership via county records.

- Research the address: Use Google Maps for street view and recent sales history.

- Insist on leases: Always get one in writing.

- Avoid sketchy payments: Steer clear of wires, gift cards, or crypto—opt for checks or apps with protection.

- Gut check: If it feels off, bail. Better safe than scammed.

Rental scams thrive on haste, but you're smarter than that. At Placerville Realty and Big Oak Management, we're committed to transparent, scam-free rentals in El Dorado County. Ready to find a legitimate home? Browse our verified listings today or contact us for a no-pressure tour.